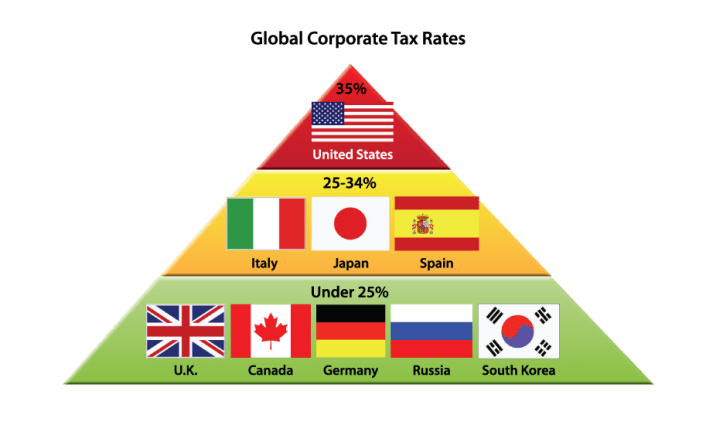

According to this article from nerdwallet.com, “The United States corporate tax rate is 35% for large, highly profitable corporations, a rate both presidential candidates pledge to lower. Mitt Romney would lower the corporate tax rate to 25%, while President Barack Obama favors 28%. Both candidates also feel the corporate tax code is too complicated and would take steps to simplify the system.”

“The Argument For Lower Corporate Tax Rates

“Proponents of lowering the corporate tax rate believe that the current rate of 35%, the highest in the world, is driving American businesses to shift their operations to foreign countries to minimize taxes. By reducing the tax rate, more American corporate income would stay in the country, increasing tax revenues despite the lower rate and keeping American jobs from moving overseas. Further, lower tax rates would increase after-tax earnings, giving companies additional income to reinvest for growth, boosting the American economy.

“Do the facts support these arguments?

“For the candidates’ proposals to be effective, there must be American tax dollars currently going overseas or otherwise not being collected that could be captured with a revised tax code. To answer this question, NerdWallet studied the tax rates paid by 500 of the largest American companies in the most recent fiscal year and found that over half of companies (51%) reported a total tax expense of less than 30% with the average reported tax rate being 27%. Further, only 8% of companies with positive earnings actually paid at least 30% of their pre-tax earnings to the U.S. federal government in the current year with the average actual tax rate being 13%. These results strongly suggest that the current statutory rate of 35% is largely ineffective.

You can read more about this “do as I say – not as I do philosophy (coroporate crapola and polit-speak)” here:

Use this interactive “Tax Rate Transparency Tool”

“NerdWallet, a leading provider of unbiased financial analysis, just released a Tax Rate Transparency Tool. Both presidential candidates are calling for a decrease in corporate tax rates, but it can be nearly impossible to figure out what companies actually pay. The tool solves this problem by allowing users to select any of 500 large American corporations and instantly see the corporate tax rate paid. The tool also provides the name and compensation of the highest paid executive.”