PHOTO SOURCE: biglicknews.blogspot.com

PHOTO SOURCE: biglicknews.blogspot.com

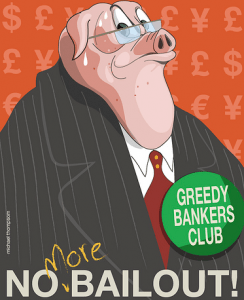

Opinion column from Jonathan Weil | Bloomberg News

“You don’t often see Washington regulators publicly raising alarms about banks’ accounting practices. That’s why a speech this week by the comptroller of the currency, Thomas Curry, deserves more attention.

“The way Curry described the situation, you get the sense that some banks’ numbers may be too good to be true. He made clear he wasn’t warning about an imminent crisis. Yet he cautioned that some banks seemed to have been ‘scrimping on their allowances against their loan losses,’ which is a fancy way of saying they may be fudging their numbers.

“To understand better what he was referring to, here’s a brief accounting primer. Loan-loss allowances are the reserves that lenders set up on their balance sheets for perceived bad loans. Provisions are the expenses they record to boost those allowances. As losses are confirmed, lenders charge off the uncollectible amounts, reducing the allowances.

“Sometimes lenders decide, in hindsight, that their allowances are too big. When this happens, they may undo some of the provisions they had previously booked. Bankers refer to this as ‘releasing reserves,’ which boosts earnings and capital. This has been happening at several large U.S. banks lately, such as JPMorgan Chase & Co. (JPM), Bank of America Corp. (BAC) and Wells Fargo & Co. (WFC) Investors often refer to these gains as ‘low-quality earnings.'”