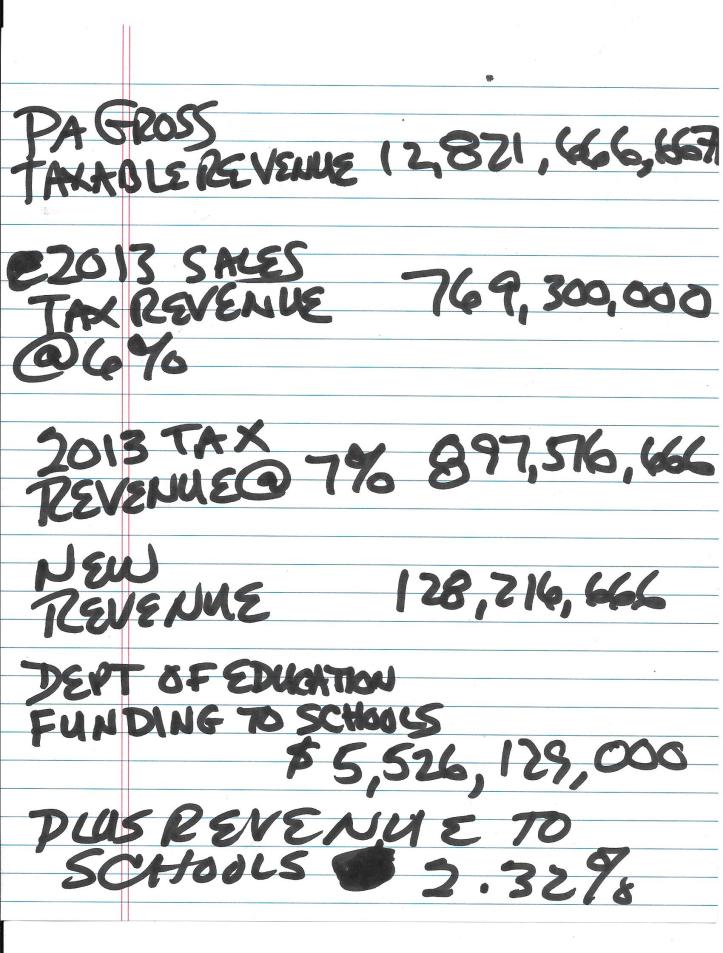

At Monday night’s meeting, a local business person suggested that a one percent increase to the Pennsylvania State sales and use tax would obviate the need to have or increase personal property taxes to pay for schools.

While not a fiscal giant in any sense, here is our quick look at that suggestion.

We calculate that adding one percent to the current sales tax application would generate about $128,000,000 dollars of new revenue. If all of that revenue would be “contributed” to the Department of Education for redistribution back to the school districts across the state, it might represent an estimated 2.32 percent increase for each school, ostensibly. Here’s the education breakdown in the 2014-2015 budget.

That would assume that all businesses collect the tax, report the tax and send the tax revenue to the state. Most likely, you, too, have seen businesses not charge tax nor give you a receipt showing the tax paid for purchases you’ve made. Here’s the sales and use tax stipulations that businesses in Pennsylvania and Columbia are supposed to follow.

That would assume that all the money would be used for property tax relief by redirecting the funds to the school districts.

SOURCE: openpagov.org

SOURCE: openpagov.org

That would assume that the school systems would not add more expenses to use these “windfall” revenues. We tend to see folks who get new money continue to find new ways to spend new money. There seems to be no accounting for getting money without examining or allocating funding for future resultant expenses predicated on the ones embraced. There just seems to be finding new ways to spend and no consideration for “future costs” such as maintenance, salary and benefit increases, unplanned expenses, etc. If you keep spending there’s never enough money.

That would recognize that the increased “new revenue” is overstated because folks buying stuff in Philadelphia and Allegheny County already pay at least 7% sales tax.

“States’ new budgets are providing less per-pupil funding for kindergarten through 12th grade than they did six years ago — often far less.”

There are those who have climbed aboard the “increase the sales and use tax and expand the taxable items” bandwagon. The Pennsylvania Taxpayers Cyber Coalition’s proposal shows the expanded tax scenario and also includes a “modest increase in the state income tax from the current 3.07% to 4.34%.” That’s a 41% increase, incidentally.

And all this might provide relief as long as there’s continued employment and spending and younger Pennsylvanians stop moving out of Pennsylvania.

Oh, yeah, last December, Pennsylvania’s sales tax and income tax revenues were under expectations.

And this Harrisburg Patriot-News article shows the kind of results when revenues don’t match the “rose-colored lens” optimism that only those in governance see when they spend other people’s money.