This comment appears following an article at Cole Umber’s news and information site:

“Cola is landlocked & cannot add anymore taxpayers. The 10, 000 existing taxpayers will forever foot the increase in expenses of this town. There is only one direction our leaders should be going in & that is propositioning the state for help in consolidating with a surrounding community. There is no expert who can make the numbers work when only 10, 000 people are trying to support a school district, a police force, & all the associated municipal forces.

Anybody who tells you different is selling you a pipe dream.”

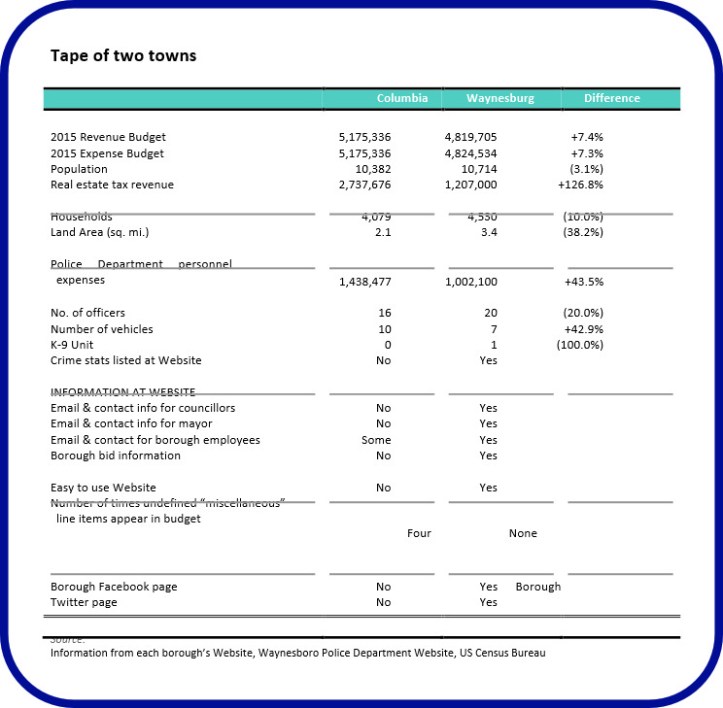

While it’s not easily possible to contrast municipalities with similarly-sized populations, here are some comparatives between two – Columbia and Waynesboro, PA – gleaned from Websites.

Pennsylvania has 176 municipalities ranging between 5,000 and 25, 000 people. Individual budgets seldom are consistent. Click on the links below see the budgets for each town.

Click on the links below to be directed to the municipal and police department Websites for each town.

Waynesboro has a higher tax millage rate; it uses a very outdated 1961 assessment model.

“Pennsylvania’s Tax Equalization Division (TED) (formerly PA State Tax Equalization Board (STEB) was established by the General Assembly in Act 447 PL 1046, 1947, to compensate for the lack of assessment uniformity statewide in distributing school subsidies.” A comparison of the municipalities listed a the 2013 report shows the property tax rate disparity.