At a recent council meeting, a citizen asked a question about the financial reporting of the three borough fire departments. The citizen was told that the borough has no control over the finances of the fire companies.

All not-for-profit organizations1 have financial disclosure obligations to the communities they serve according to IRS codes; “Within neighborhoods and communities, public charities are often viewed as critical resources, particularly where business investment is low and public programs are lacking. Even in organized and politically engaged communities, few residents watch over the local nonprofits with a sense of ownership. Some community members may become involved in an organization by serving on an advisory board or volunteering in a particular program. Nevertheless, it is rare for members of the general public to actively oversee the operations of nonprofit organizations operating in their community. Communities benefit indirectly from charities, but rarely do they demand a community impact statement or attempt to scrutinize the agency’s programs or finances.”2

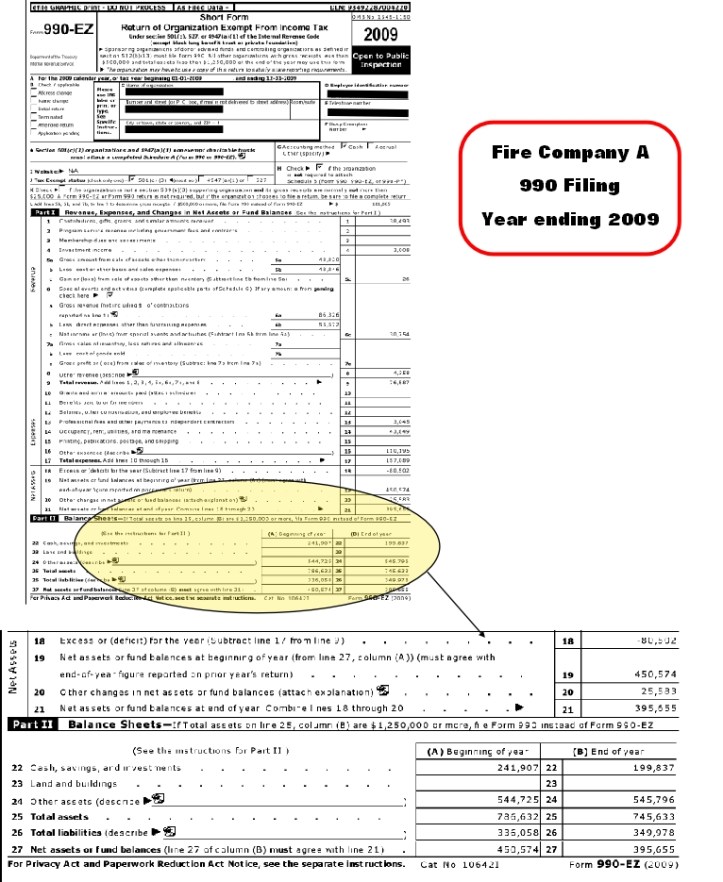

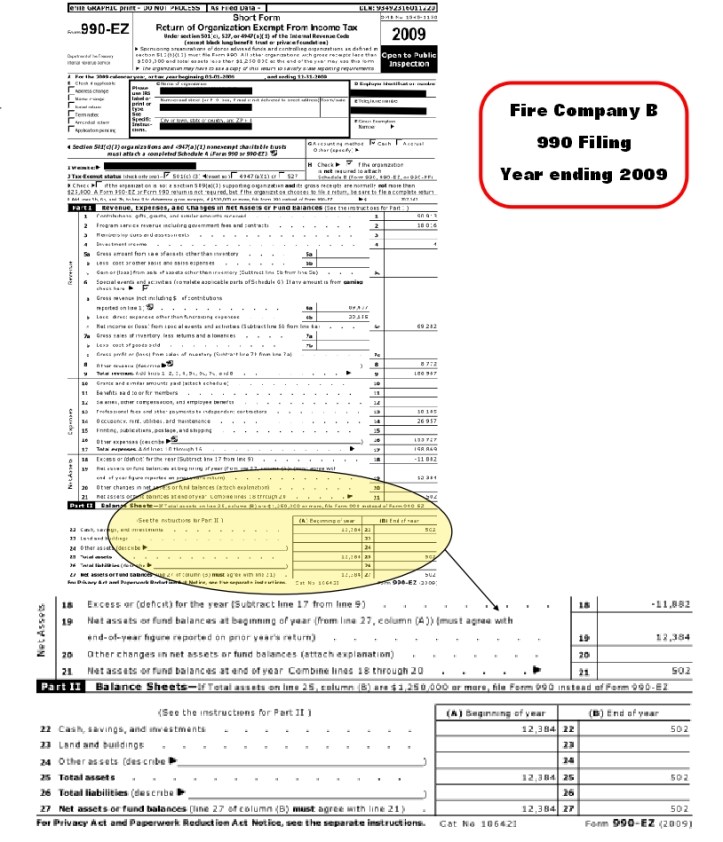

The IRS Form 990 is an annual reporting return that certain federally tax-exempt organizations must file with the IRS. It provides information on the filing organization’s mission, programs, and finances. Here are the first pages of 2009 990’s for three area fire companies.

(SOURCES: 1 – Fire companies, emergency medical services and other agencies that receive contributions or grants have financial disclosure requirements. 2 – “Reengineering Nonprofit Financial Accountability: Toward a More Reliable Foundation for Regulation“)

WOW!!! I think most of us could match the paper to the company based on these financial numbers!!!!