Today’s news and information gleanings from here and there!

Quote for today … “Oh great. More ways for drunks to drink and drive without penalty!” – comment following this Pennlive article on the recent court decision that could give folks convicted of drunk driving.

“Heat and humidity build to highest numbers so far this summer” – ABC27-TV

“Heat and humidity build to highest numbers so far this summer” – ABC27-TV

- A reprieve, perhaps, but Buzzed Driving is Drunk Driving.

- “Jon Gosselin has gone from starring on a TV show with a brood of 8 to slinging food for a party of 8 … at T.G.I. Friday’s (in Lancaster).” – TMZ

- In healthcare, as in banking and drug stores, the big keep getting bigger. “Parent company of Lancaster General Health explores another partnership.” – Lancaster Online

“There are new parking spots for trail and park users!! 40 new parking spots were just installed in front of The Columbia Water Company.” – post at Columbia Crossings facebook page

“There are new parking spots for trail and park users!! 40 new parking spots were just installed in front of The Columbia Water Company.” – post at Columbia Crossings facebook page

- Cojones or a political mistake? – The Atlantic

- Pennsylvania’s Department of State’s list of Charities in Columbia

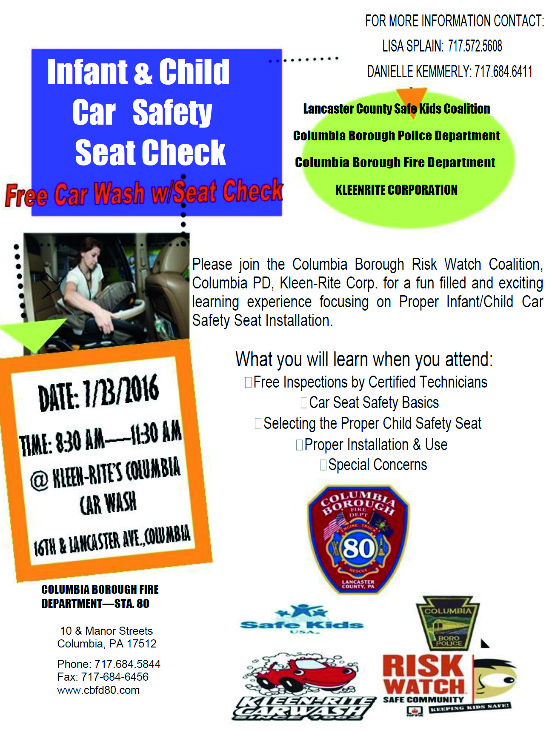

Click on the image above to see the IRS’s list of tax exempt organizations in Columbia [NOTE: Be aware there a a sprinkling of entries in New Columbia in this list.]

Click on the image above to see the IRS’s list of tax exempt organizations in Columbia [NOTE: Be aware there a a sprinkling of entries in New Columbia in this list.]

Did you know about this initiative? A reader emailed us to ask about it; seems the reader happened on its facebook page: “A non-profit organization formed to promote Columbia, Pennsylvania as a creative and vital community.”

Did you know about this initiative? A reader emailed us to ask about it; seems the reader happened on its facebook page: “A non-profit organization formed to promote Columbia, Pennsylvania as a creative and vital community.”

- So what is a non-profit organization? “So you have heard the term before, but do you really know what a nonprofit organization is? There are legal definitions, including 26 types of nonprofits recognized by the IRS, and there are common perceptions of what people mean when they refer to an organization as nonprofit.

- “Let’s start with perceptions. A nonprofit is a tax-exempt organization that serves the public interest. In general, the purpose of this type of organization must be charitable, educational, scientific, religious or literary. This is a common and broad definition that fits the type of information likely to be found at this site. The public expects to be able to make donations to these organizations and deduct these donations from their federal taxes.

- “Legally, a nonprofit organization is one that does not declare a profit and instead utilizes all revenue available after normal operating expenses in service to the public interest. These organizations can be unincorporated or incorporated. An unincorporated nonprofit cannot be given federal tax-exempt status or the designation of being a 501(c)(3) organization as defined by the Internal Revenue Service. When a nonprofit organization is incorporated, it shares many traits with for-profit corporations except that there are no shareholders.” – Read more here.

Rivertown Hops – Saturday, August 6th, noon – 4pm

Rivertown Hops – Saturday, August 6th, noon – 4pm

- Merchandiser article: “Travel By Trolley In Columbia”