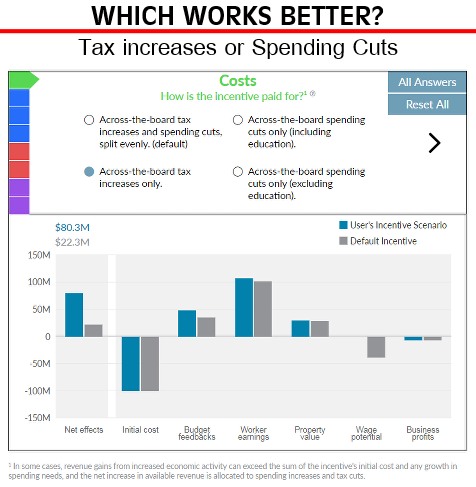

Economic Development Modeling | Governments can “use economic development incentives to encourage companies to locate or expand. An incentive has benefits for residents when the economic gains it generates, less its costs and any negative effects, are positive. This data visualization illustrates many of the impacts that incentives can have on government budgets and economies and shows how those effects are influenced by various policy choices. As policymakers and development officials evaluate their incentives, they should keep these factors in mind.”

Economic Development Modeling | Governments can “use economic development incentives to encourage companies to locate or expand. An incentive has benefits for residents when the economic gains it generates, less its costs and any negative effects, are positive. This data visualization illustrates many of the impacts that incentives can have on government budgets and economies and shows how those effects are influenced by various policy choices. As policymakers and development officials evaluate their incentives, they should keep these factors in mind.”

Read the Pew Trusts article, “What Makes an Economic Development Incentive Effective? | Data visualization lets users explore 4 factors that inform costs and benefits” in its entirety here.

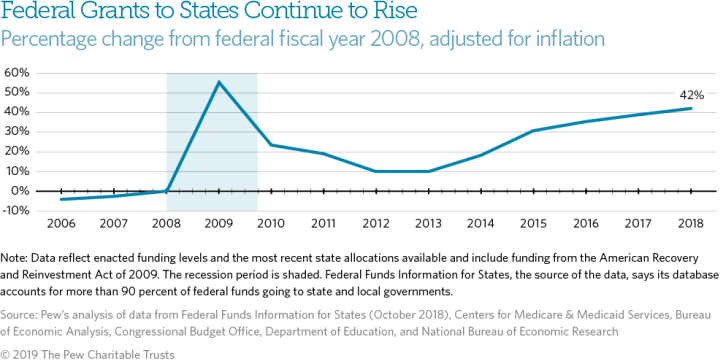

Welfare nation | Since the government bailout efforts to stop the total financial collapse, and particularly since 2014, “Federal Grants to States Rose 42% Over the Last 11 Years.”